This Time Isn't Like Last Time; Or Is It?

We are getting lots of questions on the impact of rates, so thought we would share a few observations and thoughts. The short answer: we don’t think it will have much of an impact in our corner of the world.

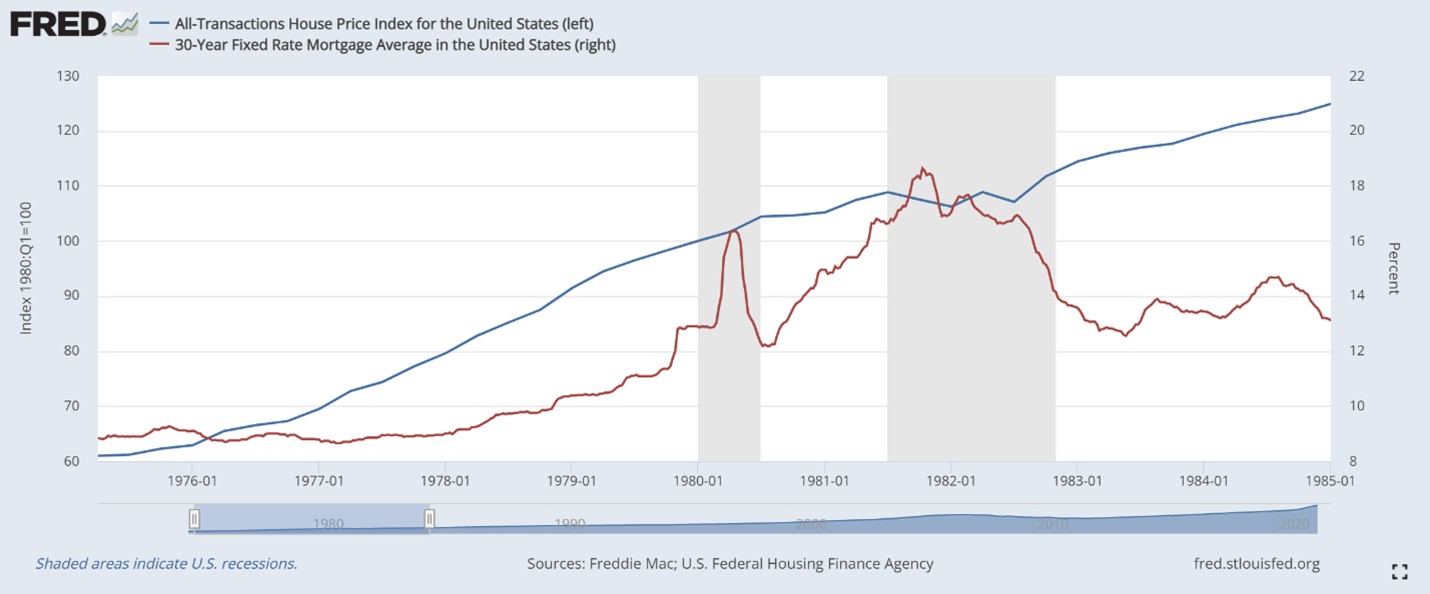

Yes, we get that this opinion does not match much of what the media is reporting. So, what are we looking at? The biggest factor is the Millennials, who are just at the beginning of their home buying years. You may not recall, but this isn’t the first time a large demographic bubble will work its way through the system. The same thing happened with the Baby Boomers in the 70s and we can look at what happened to them to get insight into the current condition. Harvard researchers concluded in “The Baby Boom, The Baby Bust, and the Housing Market”[1] that the huge demographic demand overrode all other factors, including interest rates. This is all the more stunning considering mortgage rates rose during that period from 10% to 18%. Here is a chart of home prices vs interest rates (blue line is home prices, red is rates, and the shaded zones are recessions).

We expect this scenario to play out in much the same manner today. As Millennials begin their home-buying years, they are in good financial condition, overall. Certainly not all Millennials are in good shape, but overall, they have saved up quite a bit and are in better financial condition than even some Boomers[2]. And just like home buyers before them, they will give up other areas of spending to pay for a house and unlike the Boomers they have fewer ‘committed’ expenses (i.e. children) than Boomers before them[3]. And note that the Boomer ‘push’ started with a rapid rise in prices, but that slowed over time, and we expect the same to happen this time.

Much of the ‘world-is-ending’ analysis looks at mortgage applications, which mixes includes refi and therefore does little to help when considering just home purchases. For example, here is an article from the NY Post titled “The Fed’s new moves could turn the housing market from boom to bust”[4] that postulates “Little wonder then that we are already seeing a major slowdown in mortgage applications — a poor omen for future house price prospects”. The data they use, though, is a mixed bag. Total mortgages include both refinances, which is very volatile and of course is slowing as rates go up; and new purchases, which doesn’t seem to be slowing down and is not very sensitive to rates. Here, for example, are the estimates from Freddie Mac[5], which break out the two:

The highlighted portion is the new purchases, and you can see the expectation is for a slight increase during 2022, while the refi volumes below the highlight are expected to be cut in half. These two types of ‘mortgages’ can only be conflated to the detriment of usefulness.

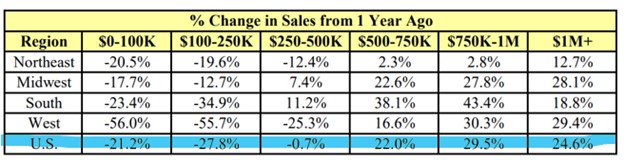

Now, certainly we aren’t so Pollyannish as to think there is no impact, because absolutely there is. But it really is focused on the low end of the spectrum. Check out the latest Existing-Home Sales from the NAR[6]:

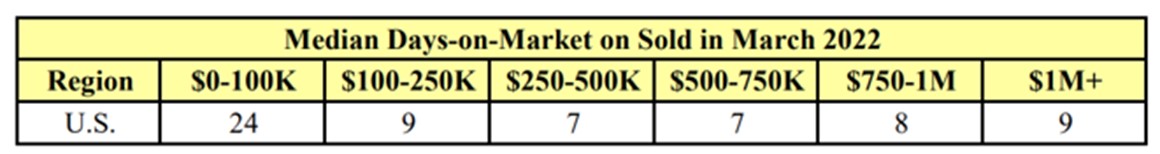

I highlighted in blue what I am talking about. Yes, overall sales were lower, and this drop followed a decline of 7.2% in February, so it’s real. But the slowdown is not across the board and is very much concentrated in the low end, which is getting crushed, but the rest of the market is holding up quite well. Days on market confirms that the low end was never all that great anyway:

And, of course, we don’t speculate on individual homes, we just lend into it. We lent during the Great Financial Recession, and things went just fine for our borrowers and investors, in fact many are still with us. And mortgage rates were in the 8s then.

So, there’s the long answer: we don’t think it will have much of an impact in our world.

[1] https://scholar.harvard.edu/files/mankiw/files/baby_boom.pdf

[2] https://www.cnn.com/2022/04/27/investing/retirement-millennials-boomers-saving-more/index.html

[3] https://www.pewresearch.org/social-trends/2018/01/18/theyre-waiting-longer-but-u-s-women-today-more-likely-to-have-children-than-a-decade-ago/

[4] https://nypost.com/2022/05/04/the-fed-could-turn-the-housing-market-from-boom-to-bust/

[5] https://www.freddiemac.com/research/forecast/20220418-quarterly-forecast-purchase-market-will-remain-solid-even-mortgage-rates-rise

[6] https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales