Housing Market Hangover

In October 2022, I wrote an article entitled “Bottoms Up” where I discussed our belief that the housing market was returning to normal. The conclusion/TLDR was: “The ’top-down’ (macro or big picture or overall averages) indicates a market that is continuing to cool after a very hot period. It is expected to come off 10% or so over the next 3 years. The ‘bottoms up’ (what our investors are seeing) remains optimistic and busy with plenty of opportunities.”

We didn’t crash. Although prices have cooled, and will probably cool a bit more, we’ve never been in the ‘crash’ camp – and still aren’t - or we wouldn’t have been lending money at the valuations we were or do now. While the peak is probably behind us for a while, it is nice to no longer have to put up with the talking heads on the news trying to outdo each other calling for an imminent housing crash.

So where are we? We are seeing lower volumes at prices which have only modestly declined, which is exactly what the economics of supply and demand would tell us. And if prices are going to stabilize around these admittedly elevated levels, plus or minus a bit, how does this resolve? The answer is TIME – it’s just going to take a while. And as anyone will tell you: there is no magic potion for beating hangovers—and only time can help.

Let’s call this a housing market hangover. So how bad will it be? Let’s see how we got here.

The first step, if you recall from a few years ago, conditions were rife for an expansion: easy money, lots of Millennials and demand for a first house, people resettling out of states they were no longer happy with, explosion of work-from-home, etc. There are lots of reasons. All that demand butts up against a supply that just can’t keep up, and prices go up. And up. And then FOMO kicks in and suddenly everyone is doing it. Including people who shouldn’t.

Second, inevitably the party ends, and it tends to end quickly. Think lights getting turned on at the end of the party – everyone knew it was getting a bit late and silly, but now the lights are on, and everything looks very different, and what seemed like a very good idea just a few minutes ago now seems much less interesting. And your head is starting to hurt. Certainly, you can crash and burn and that may be the most likely scenario if you have really overdone it. Or maybe you can go about your business a bit tenderly for a while and then shake it off and get back in the game. So, which is it this time?

This time, the current state of the market looks much more like just a nasty hangover. As many have pointed out, last time loans were much easier to get – in fact too easy as you didn’t even need a job or any assets; prices ripped much faster on a percentage basis; people did not have much equity; incomes were lower, a lot of supply came on line, etc. So a crash and burn seemed to make sense last time.

But this time is different. Yes, mortgage rates have increased and, yes, that’s a negative, so we can take easy money out of the drivers of demand. But what of the other drivers: demand for a first house, migration from more populated states, work from home, etc? Those still exist. And the point is not that there is no slowdown, there is and prices are starting to come down. For sure. Now we should be asking how bad it is going to be. And how long does this slowdown last? This is going to be much less severe, but no one enjoys hangovers.

The concerning part of this slowdown forecast is turnover, possibly even more so than prices. We continue to expect a few more years of this type of lower turnover market. Our real estate investors need homes to become available – investments that they can then improve the value of, and then they need to sell those now nicer homes for a profit. That is all turnover. Certainly, turnover is a related function of price, but our investors add about 15-20% value to the houses they work on, whether overall market prices are high or low. Interestingly, the amount of work and time required to do that type of work has remained relatively unchanged as reflected in relatively stable budget percentages and loan times.

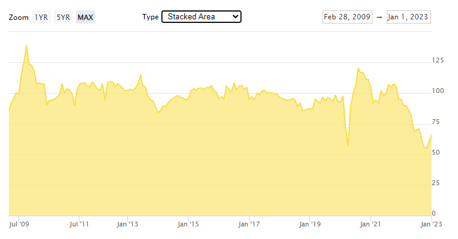

Turnover does seem to be coming back, albeit at more normal levels, like we saw pre-pandemic. Looking at the National Association of Realtors (NAR) Pending Home Sales Index, and looking at the ‘West’ region, February has recovered by about 10% off the November lows[1]. Here is a visualization of that historical data (West region only) [2]:

NAR also makes forward predictions and while they do not break out their Existing Home Sales by region, they are forecasting further improvements, with existing single-family sales (on a national level) expected to be about 20% higher by 1Q24[3].

And this is consistent with what I am seeing here in Colorado. It was great to see everyone at the ICOR event in Lakewood on March 29th. It was good to see people I haven’t seen for a long time, as well as some new faces. Usually, these events have 50 or so people, this one had over 200 sign-up and I bet there were over 150 in attendance. Just another sign that the real estate investment market is still filled with optimism and opportunities for those willing to roll-up their sleeves and get to work. If I didn’t get a chance to say hi and introduce myself, I would love to connect. I’ll help with an even shorter TLDR and even borrow from last time:

TLDR: “The ‘bottoms up’ (what our investors are seeing) remains optimistic and busy with plenty of opportunities.”

[1] https://cdn.nar.realtor/sites/default/files/documents/phs-02-2023-pending-home-sales-03-29-2023_0.pdf

[2] https://www.mortgagenewsdaily.com/data/pending-home-sales

[3] https://cdn.nar.realtor//sites/default/files/documents/forecast-q1-2023-us-economic-outlook-02-27-2023.pdf