Cheap Markets Equal High Cash Flow. Here’s Why That Doesn’t Work.

The thesis is simple. Rental properties in cheap markets will generate a higher cash flow. This sounds promising, if it were only true.

By “cheap markets” we’re referring to cities such as Memphis, Birmingham, Jacksonville and Cleveland. The gurus, you know the ones selling expensive courses and seminars, their goal is to bring investors and wholesalers into these markets. They do so by promising higher cash

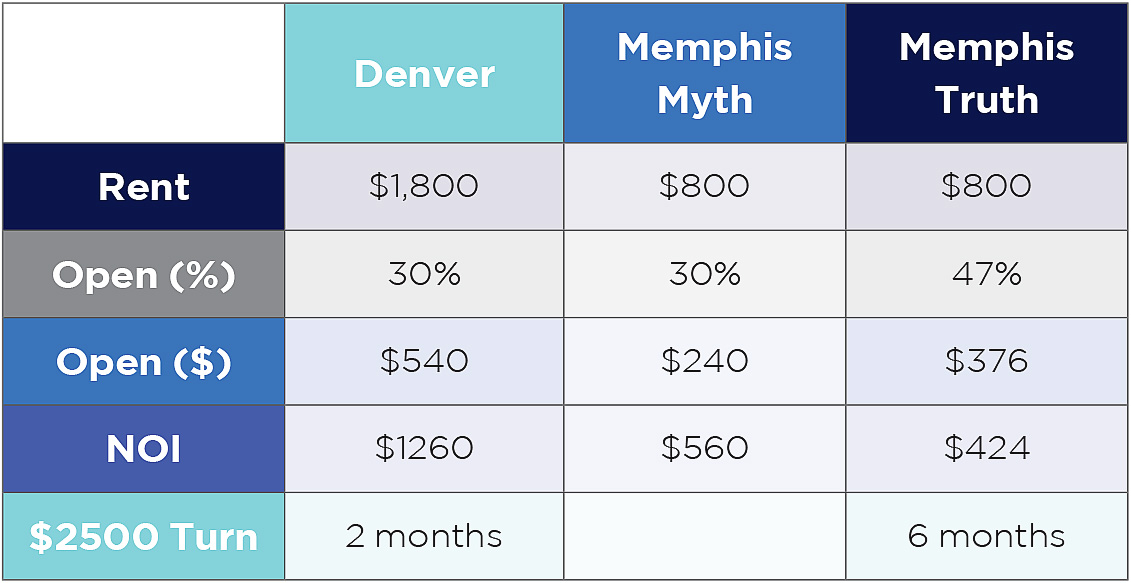

flow while maintaining operating expenses (OPEX) at 30%.

The problem with investment properties in these cities is that the market rent is also cheaper, while the maintenance costs remain the same. A water heater for instance, is going to cost the same whether purchased in Colorado or in Tennessee. It will, however, eat up a larger percentage of the rent in markets like Tennessee. Instead of 30%, the true OPEX is now closer to 47 – 50%.

We know this from experience. One of our collogues is currently selling 14 Memphis single family homes with the goal of replacing them with better preforming assets in Colorado. The numbers above are based on his real-life experience.

Why are the Projections Misleading?

The pro forma and models these gurus are using are based off of general market data. In a larger city, a 30-31% OPEX is fair, but where rents are lower, the numbers begin to not add up.

This is because they often don’t own real estate in the markets their selling in. One question you should always ask your advisors is “Can you show me the numbers on your properties?” and “What do you own in this market?” If they don’t have answer for you it’s time to find an investment specialist who does.

Why we Invest in 20-year Markets

Location really does make all the difference. When we look to maximize return on investment, we do so by not only looking at cash flow, but at appreciation. Truly understanding the path of development in a particular city provides the specific knowledge required to make the right investment. One that not only produces solid cash flow, but that also has a higher annual appreciation year after year.

This is a long game. Markets like Denver, Boise, Charlotte and Phoenix are where we like to place our money and where we advise our clients to do the same. Don’t be fooled by fancy accounting!