Be the Mortgage Bank Instead of the Landlord: Unlocking Passive Income Potential

Are you tired of the day-to-day hassles of being a landlord? Repairs, tenant issues, and the constant upkeep of rental properties can be a source of stress for many real estate investors. But what if there was a way to generate passive income without the headaches of traditional property ownership? Enter the world of hard money funds.

Investing in a hard money fund offers the opportunity to be the mortgage bank, rather than the landlord. These funds have gained popularity in recent years due to their attractive returns and low maintenance requirements, making them an excellent choice for investors seeking passive income, or what some like to call "mailbox money."

The Power of Passive Income: Earning 7-10% Returns

One of the most compelling aspects of hard money funds is the potential for robust returns. While traditional “passive” real estate investments may yield returns in the range of 3-6%, hard money funds typically offer returns of 7-10% or more. This means that your money can grow significantly faster when invested in these funds.

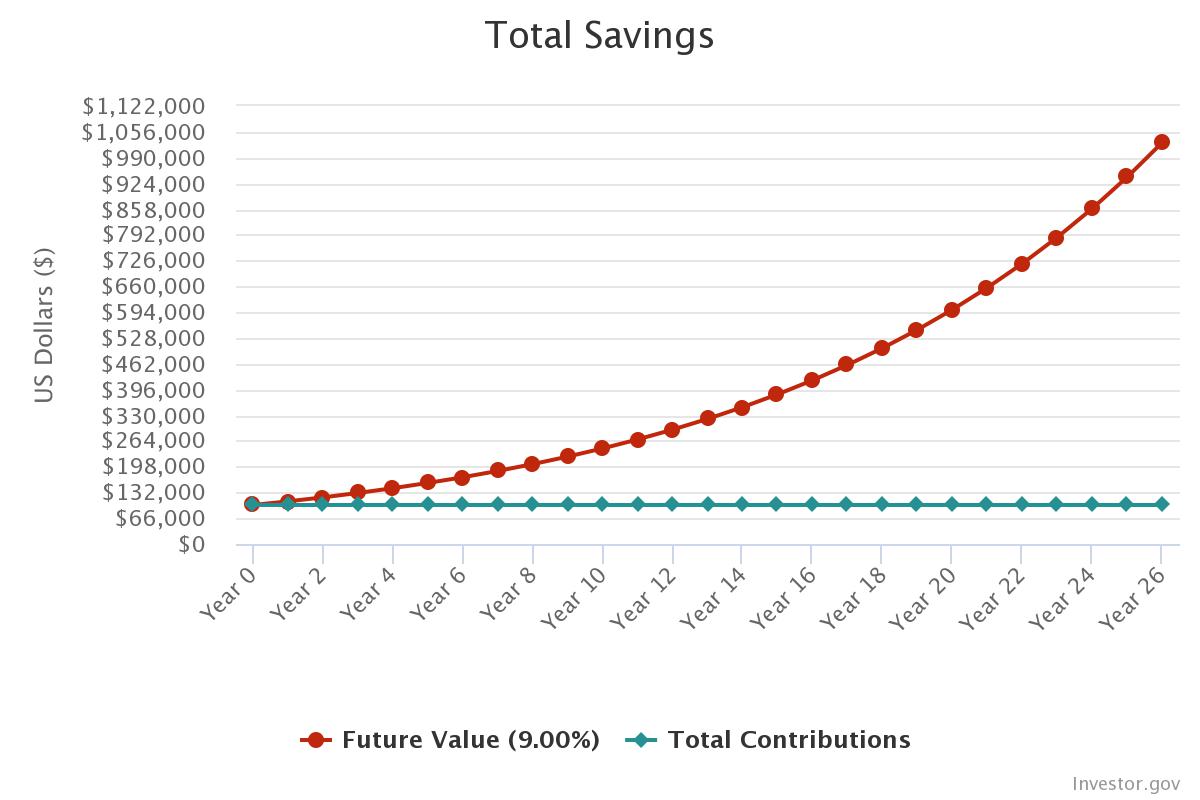

Let's illustrate the power of this strategy with a simple example. If you were to invest $100,000 in a hard money fund offering a 9% annual return, your initial investment would double in value by the end of the 8th year. By year 13, it would triple. But here's where it gets exciting – due to the magic of compounding interest, by year 20, you would have six times your initial investment, and 10x by year 26. That's the extraordinary power of compound interest in action, and it can be a game-changer for your financial future.

Diversification and Risk Mitigation

Diversification is a crucial aspect of any investment strategy. When you invest in a hard money fund, your money is typically spread across a variety of real estate loans, reducing the risk associated with owning a single property or dealing with a single tenant's issues. Diversification can help protect your investment and enhance the overall stability of your portfolio.

Investor Accessibility

One of the most appealing aspects of hard money funds is their accessibility. They are available to a broad range of investors, whether you're just starting your investment journey or you're an experienced investor looking to diversify your holdings. The flexibility and accessibility of hard money funds make them a versatile tool for building passive income.

What's more, hard money funds offer a unique advantage in terms of "partial" liquidity. Since loans within the fund typically have relatively short durations, with payoffs occurring in about 4-9 months, liquidity is often available within approximately 90 days of requesting funds. This feature provides a level of flexibility that is not commonly found in traditional real estate investments, where your capital may be tied up for several years. The ability to access your funds relatively quickly when needed can be a valuable safety net for investors, offering both growth potential and peace of mind.

A fantastic source of capital to consider for your hard money fund investment is to move your IRA funds into a self-directed IRA. Self-directed IRAs offer investors greater control and flexibility over their retirement funds, allowing you to choose a wide range of investments, including hard money funds. By using a self-directed IRA, you can maximize the potential for growth, take advantage of the compelling returns of hard money funds, and enjoy the benefits of compounding interest while securing your financial future.

Conclusion

In today's real estate investment landscape, being the mortgage bank instead of the landlord is an attractive proposition. Hard money funds offer the potential for high returns, the power of compounding interest, and Security through Diversification. These features, combined with the reduced day-to-day management responsibilities, make hard money funds an excellent choice for investors seeking passive income.

As with any investment, it's important to conduct due diligence, understand the fund's structure, and assess the associated risks. However, if you're looking to take a step back from the landlord's role and enjoy "mailbox money," exploring hard money funds may be the key to unlocking your financial success and building a more prosperous future.