2024 Election Implications for Housing Market

*This article originally appeared at https://jbrec.com/insights/2024-election-results-effect-on-housing-inflation-economy-immigration on November 15, 2024.

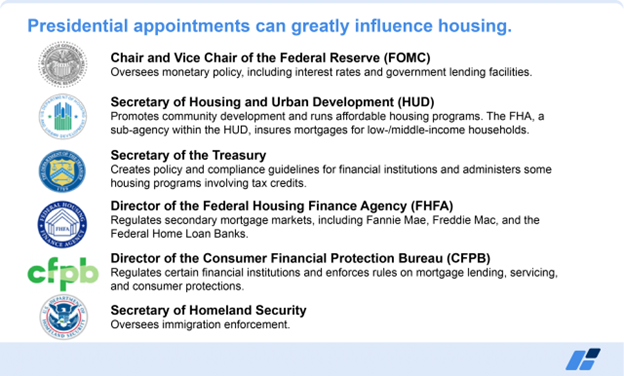

Presidential policies and appointments can greatly influence housing for years to come. Our clients are interested in understanding the implications of the recent election results, so we’ve put together a brief overview with our initial insights to offer timely perspective:

1. Housing policies and key government agency appointments

The incoming administration has proposed the following policies (though they are not yet confirmed). Some of the policies have the potential to help the housing shortage and affordability crisis, while some could exacerbate these issues. As a reminder, we estimate that the US is undersupplied with housing and needs 1.5 million additional vacant units to return to balance, including 630,000 for sale and 830,000 for rent.

- Expanding home construction on federal land: This change in policy could increase housing supply and affordability, but it may face regulatory, environmental, and infrastructure challenges. Making more federal land available for construction could help move the needle faster on supply and affordability, especially if tax/financial lures were dangled to developers. Lot prices today range from 23% of new home prices in Florida to as much as 41% in Southern California, according to our 3Q24 Residential Land Survey. In addition, residential land brokers consistently tell us that developed lots and land supply remain either somewhat lower or much lower than normal in most parts of the country.

- Implementing tariffs: Tariffs may increase inflation by raising the prices of imported goods, which can lead to higher costs for consumers and businesses. Higher costs for imported building products can also increase construction expenses, making housing less affordable. This could be especially acute on the supply chain and pricing in the short-term; US-based manufacturers and suppliers likely need time to prepare and scale up in anticipation of demand for domestic goods possibly picking up should tariffs sharply rise. Homebuilders and building products dealers we survey and speak with monthly indicate that the supply chain has generally normalized following several years of volatility, and they’d prefer keeping it that way going forward if possible.

- Ending the SALT (State and Local Tax) cap: Eliminating or increasing the SALT cap (currently limited to $10,000) could benefit high-priced markets most by allowing residents to deduct more of their state and local taxes. Ironically, some of the strongest housing markets in the country today are already those in upper price ranges along the coasts that would disproportionately benefit from this proposed change (California and the Northeast mainly). For example, our Burns Home Value Index™ shows that home prices in Orange County, CA, and the New York metro area are up +7% YOY, versus national home prices up just +3% YOY.

- Reducing regulations: Deregulation could lower construction costs and increase supply quicker but may raise environmental and quality concerns. One area we’re watching closely is financial services, as any regulatory shifts could impact banks and the broader mortgage lending landscape, including underwriting requirements. The government plays an integral part in the mortgage market via its oversight of Fannie Mae, Freddie Mac, FHA, and VA loans, which combined accounted for 70% of first-lien mortgage originations in 2023 and 61% in 2024.

Key presidential appointments that will influence housing and mortgage markets include:

- The heads of the FHFA¹, HUD², and CFPB³

- Leadership at the Federal Reserve

2. Inflation and the economy

- High inflation expectations: The market is now expecting slightly higher inflation over the next several years, fueled by expectations for continued economic growth, uncertainty around tariffs and immigration, and concerns around deficit spending. Rising inflation expectations are reflected in higher long-term interest rates, which increase the cost of borrowing for both construction and home purchases.

- Higher mortgage rates: With a strong economy and expectations of greater inflation, 10-year Treasury rates are likely to stay elevated relative to 2011–2022 levels, suggesting that mortgage rates will likely remain higher for longer. In fact, mortgage rates are now expected to average around 6.30% in 2025 based on our analysis of the bond market’s forward pricing expectations and spreads, up from a pre-election estimate of 5.90% next year.

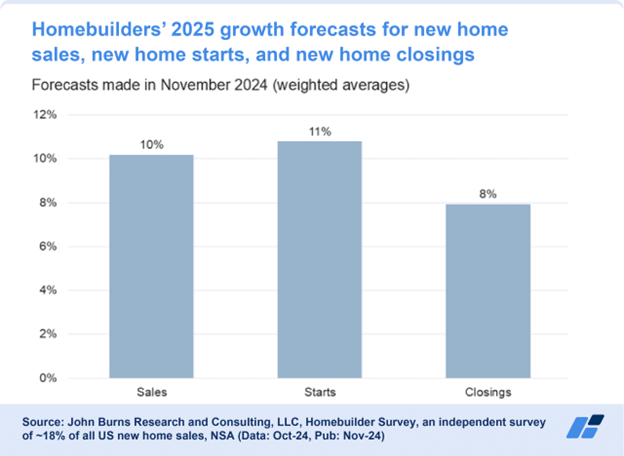

- Builder optimism: Builders remain optimistic, likely based on the belief that a strong economy, even with elevated mortgage rates, is preferable to crashing interest rates driven by a recession. Builders will also continue to capitalize on their ability to buy down rates during high-interest rate periods, a major advantage over the resale market. We surveyed ~300 homebuilders in early November just before the election, and nationally, they expect sales (orders), starts, and closings to grow between +8% and +11%, as shown below.

3. Immigration and deportation policies

Immigration is likely to slow in the coming years, a trend that has already gained steam in 2024 under the current administration. This primarily impacts housing in the following ways:

- Reduced rental demand: Slowing immigration could lower the number of renters entering the market, decreasing occupancy rates and cooling some of the strength we’ve seen in absorptions during recent quarters, which also coincided with record levels of immigration. By our estimates, from 2022–2024, immigration was responsible for all of the 1.0 million net growth in renter households. Adults already living in the US pre-2022 were responsible for 95% of the net growth in owner households from 2022–2024, so we don’t expect as significant of an impact on the for-sale market in terms of demand.

- Loss of construction labor: Undocumented immigrants made up 23% of the workforce in 2021 (likely higher now). Any supply shock to construction labor would undoubtedly be felt by the homebuilding industry, as roughly 50% of both building materials dealers and homebuilders we surveyed ahead of the election already indicate labor as their top concern. Prolonged construction labor shortages would likely result in higher home prices and/or longer build cycle times.

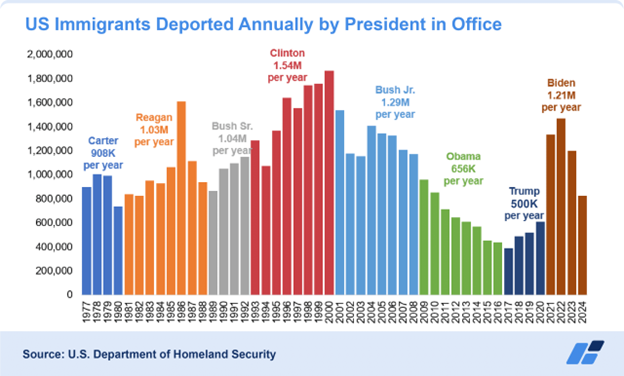

- Deportations: Our demographics research (led by Eric Finnigan) indicates that deportations aren’t abnormal. In fact, annual deportations from 1977–2023 averaged 1.1 million, with the highest occurring under Clinton and the lowest under Trump’s first administration. What would be abnormal, however, is the possibility of elevated deportations combined with extreme restrictions on immigration.

By Rick Palacios, Jr, Real Estate Market Expert

John Burns Research Consulting