Are Mineral Rights Considered Real Property?

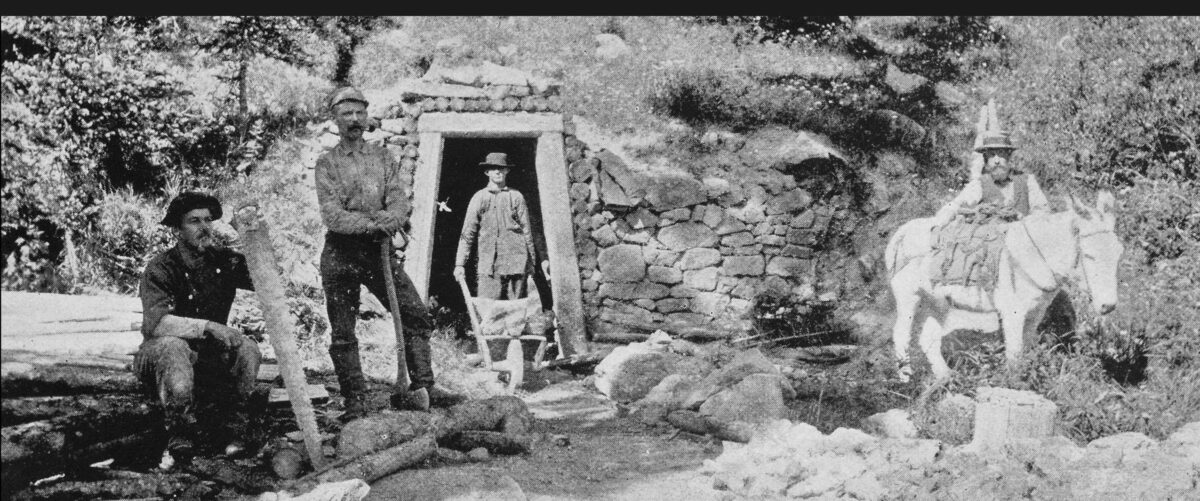

Colorado has a rich history of mining that still plays a big role today.

Knowing the ins-and-outs of mineral rights investing can be complex and requires a certain amount of expertise to truly understand. Many investors often ask the question, “Are mineral rights real property or personal property?”

It’s a valid question and there’s some justification for either way the question is answered. However, mineral rights are legally classified as real property. Here’s an explanation and what you need to know about your real property.

Why Mineral Rights Are Real Property

By definition, real property includes the land and anything that is permanently attached to the land. This means buildings, roads, fences, bridges, trees, water and minerals are all classified as real property. But even though mineral rights are considered to be real property and a tangible investment, they can still be sold separately from the surface rights. This complexity is one of the many reasons why it’s important to seek expert advice with any mineral rights investing. Contractual agreements regarding the sale, transfer or lease of oil and gas minerals are extremely detailed, so it’s important to know what the agreement states as being real property versus personal property.

Surface Rights vs. Mineral Rights

If you’re interested in purchasing land, you can’t assume the mineral rights come along with it. It’s entirely possible for one person to own the surface rights and a different person own the mineral rights. The surface rights simply mean the owner can do whatever they want on the surface of the land in accordance with the law. Before rushing into an agreement thinking you’re purchasing both surface rights and mineral rights to a property, your lawyer or other professional should evaluate the language in the contract to ensure you are the owner of both.

What Mineral Rights as Real Property Means for Investors

Since minerals are recognized as real property, what does that mean for potential investors? The classification of mineral rights as tangible assets brings with it a sense of stability – it is an asset that is owned in perpetuity that can be passed down to future generations. With an investment in mineral rights, investors benefit from a consistent stream of passive income, helping to shield their overall portfolio from the volatility of traditional markets, while benefiting from the security and diversification that come with ownership of real property. This makes mineral rights a unique investment avenue that not only has lucrative long-term benefits but also aligns with a tangible and time-tested form of wealth preservation, making it an ideal choice for those seeking to build and protect their portfolio.

Always Seek Expert Advice with Mineral Rights Investing

Since oil and gas minerals are considered to be tangible investments in real property, you have to treat them as such for tax purposes. Every situation is unique, so you can do as much research online as you think is necessary and still may not find out everything you need to know about your mineral rights. Experts in alternative investments and mineral rights investing are experts for many reasons. They know how to make sure you’re not only classifying your mineral rights per the law, but they also ensure you get the most out of them when you sell or lease them.

Eckard Enterprises is here to help you understand your mineral rights thoroughly. We work with investors to ensure they are receiving the maximum benefits from their oil and gas minerals and alternative investments. Whether you’re an individual interested in mineral rights investing or a major investment company that wants to diversify their portfolio, contact us today to see how we can help you.