Low Supply is Driving Rising Prices in the Midwest

Key takeaways:

- The Midwest is seeing some of the nation’s strongest home price and rent growth at this point in the cycle yet remains among the most affordable regions in the US.

- A limited supply of new construction and resale homes is responsible for the region’s pricing power.

Despite the price growth, Midwest job growth is the slowest of the regions, though specific markets stand out.

Home price and rent growth remain solid

Some of the strongest price appreciation right now is in the nation’s heartland, with Midwest resale home values up +5% year-over-year (YOY) through January, just below the growth rate in the Northeast. Our proprietary monthly survey of homebuilders confirms more of the same: on average, builders reported +5% YOY growth in new home prices (net of incentives).

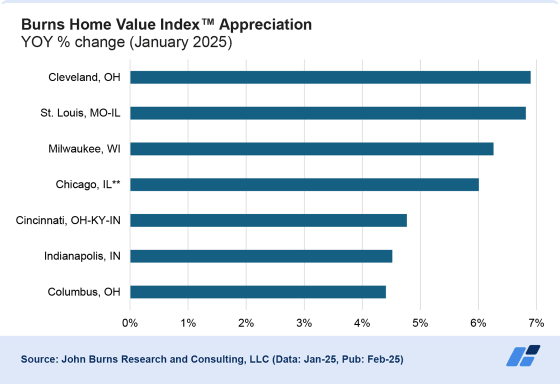

Resale home values are up YOY:

- +7% in Cleveland and St. Louis

- +6% in Chicago and Milwaukee

- +5% in Indianapolis and Cincinnati

- +4% in Columbus, OH

For-sale housing is not the only market experiencing price growth. Our Single-Family Rent Index™ shows YOY changes in single-family rents of +5% to +7% in the largest Midwest markets.

The Midwest apartment market is the strongest region in the nation now, according to JBREC’s multifamily housing expert Chris Nebenzahl. Rent growth has been steady by historical standards, with most markets growing between +2% and +3% on an annual rent growth basis, and occupancies are holding strong, too.

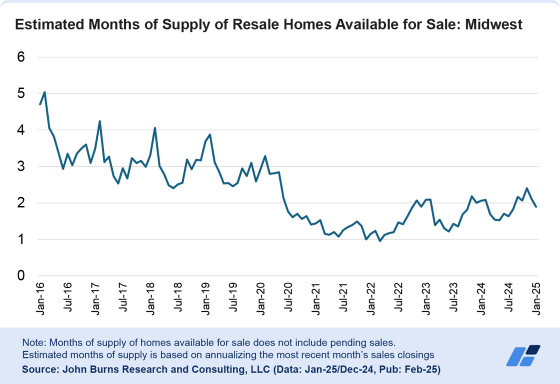

Low supply drives the Midwest’s pricing power

- In the resale market, the Midwest’s 1.9 months of homes available for sale is well below the national average. This measure of relative supply is rising rapidly in other parts of the country, such as Texas and Florida.

- In the new home market, homebuilders report 1.5 unsold, finished new homes per community for January 2025, an increase from 1 year ago but significantly lower than the 2.7 homes nationwide.

New construction is rising again, with single-family permits across core Midwest metro areas rising +12% YOY. New multifamily supply remains limited. Resale listings in key Midwest markets were still -44% lower in January 2025 than in January 2019, which was a more normal year for resale supply.

The Midwest is not without its challenges

Job growth remains the slowest in the country, rising at +0.5% YOY on average for key Midwest markets. High-income jobs—which we can correlate to new home demand—are falling. Indianapolis remains the standout here, where +2.4% YOY growth is among the strongest large markets in the country.

On a positive note, we are beginning to see sales activity—for new and resale homes—start to bottom out. Resale sales closing activity in the Midwest region is positive YOY for the first time since mid-2022, and new home sale closings are not far from seeing positive growth, too.

Conclusions

The Midwest is popping up on our radar more frequently as the low-supply environment. Current pricing power presents plenty of opportunity.

Even so, within the region, there is a wide range of market performance—the for-sale market appears stronger in Indianapolis and Chicago, more expected in Minneapolis and Columbus, OH, and slower in Cleveland, St. Louis, and Kansas City. Staying on top of the trends in each market is crucial to success.

*This article originally appeared at https://jbrec.com/insights/midwest-housing-market-boasts-affordable-homes-but-low-supply-rising-prices on February 26, 2025

By Chris Porter, John Burns Research Consulting

Out of State Real Estate Market Expert